Assignment 3

Goals of Assignment 3

Add a Field in ArcMap

Calculate Z-Scores From Data in ArcMap

Use Probability to Predict Occurrences of a Given Percentage

Create a Report Connecting all of the Data

Introduction

Foreclosures are "the action of taking possession of a mortgaged property when the mortgagor fails to keep up their mortgage payments" (Google Dictionary), and this spatial analysis is being conducted as a response to an increasing concern among Dane County officials due to increasing foreclosure numbers in the county. A census tract are "small, relativity permanent statistical subdivisions of a county, uniquely numbered with a numeric code" (United States Census Bureau) and average about 4,000 people per tract. The purpose of this project is to determine the z-scores of three census tracts, to determine the number of foreclosures that have an 80% and 10% likelihood of occurring, to determine whether the number of foreclosures will increase in 2013, and to perform a spatial analysis to determine changing patterns in foreclosures by census tract in Dane County, Wisconsin, from 2011-2012.

Methodology

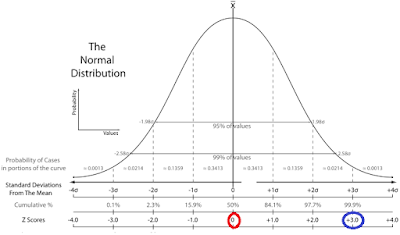

To determine z-scores, the probability of an increase in foreclosures in 2013, and the spatial relationship of foreclosures in Dane County between the years 2011 and 2012, three operations were performed: a hand calculation of z-scores, a hand calculation of the probability of an increase in foreclosures in 2013, and a spatial analysis of foreclosure data mapped using ArcMap. A z-score is simply the distance, in standard deviations, above or below the mean that a raw score falls on, as seen in Figure 1 (two example z-scores circled in red and blue) which allows us to explain the probability of an observation occurring. Z-scores of census tracts 25, 108, and 120.01 were calculated using data for 2011 and 2012, while the probability of an increase in foreclosures used 2012 foreclosure data exclusively. The formula used to calculate z-scores and probability is shown in Figure 2, where z is the z-score, X is observation, μ is the mean, and σ is the standard deviation for this data set. The observation, mean, and standard deviations data were found using ArcMap classification statistics. The final task was mapping the changes in foreclosures for the entirety of Dane County. A new field was added in ArcMap, named change, representing the difference (positive or negative) in the number of foreclosures observed between 2011 and 2012. Another chloropleth map was then created using the Count2012 data that comprises the total number of foreclosures in Dane County in 2012 (Figure 6). Two additional maps (Figures 7 and 8), using the Count2011 and Count2012 data columns in ArcMap, were then created in ArcMap and displayed the total number of foreclosures using the standard deviation classification method. This allowed for a connection between z-score calculation in census tracts 25, 108, and 120.01 and the data displayed on these maps. The 2011 foreclosure map portrayed the data in four standard deviation classes while the 2012 foreclosure map portrayed the data in five standard deviation classes. All analyses utilized information provided by Dr. Ryan Weichelt and consisted of geocoded addresses of disclosures and all census tracts that contain these addresses in Dane County and a z-score chart (Figure 3).

Figure 1: Normal Distribution with Z-Score Distribution

(http://www.statisticshowto.com/when-to-use-a-t-score-vs-z-score/)

Figure 2: Z-Score Formula

(https://openlab.citytech.cuny.edu/2013-spring-mat-1272-reitz/2013/05/page/2/)

Figure 3: Z-Score Chart

Results

The z-scores for census tracts 25, 108, and 120.1 were calculated (using Figures 2 and 3) and the results are portrayed in Figure 4. In 2011 the mean number of foreclosures in Dane County census tracts was 11.39 while the standard deviation was 8.78. Census tracts 108 and 120.01 both have more foreclosures than the mean whereas census tract 25 falls below the mean (Figure 7). These z-score values change when looking at the 2012 data (Figures 4 and 8). The mean increased to 12.3 (due to an overall increase in the number of foreclosures in 2012 over 2011) and the standard deviation increased to 9.9, reflecting a slight spreading of data about the mean. Census tract 25 moves farther from the mean, reflecting a decrease in foreclosures, census tract 108 moves closer to the mean, also representing a decrease in foreclosures, while 120.01 increases drastically so that it is now 3 standard deviations from the mean (Figure 8). The number of foreclosures that is likely 80% of the time is 3.98 while the number that is likely 10% of the time is 24.97 (Figure 4). Figure 5 represents the total changes in the number of foreclosures in census tracts between 2011-2012 using the Jenks Natural Breaks classification method. There was an overall increase in foreclosures in Dane County from 2011-2012 ((evidenced by the increase in mean mentioned previously), but this increase is not distributed evenly among the census tracts and a spatial pattern emerges. The highest numbers of observed increases (11-16), occurred in seven census tracts (including census tract 120.01) on or near the outer edges of Dane County, primarily in the east. More moderate increases (1-9) occurred in or near the center of the county and on the western edge of Dane County. Decreases in foreclosure rates were most pronounced (-14--6) in census tracts 120.02 and 132 (among others) and all decreases generally run along a line running northeast to southwest from census tract 117 to census tract 126. Using Figure 5, we observe that census tracts 25 and 108 had 2-5 less foreclosures in 2012 while census tract 12.01 had 11-16 more foreclosures. Figures 7 and 8 portray the total number of foreclosures using the standard deviation classification method by year. These maps, used in conjunction, show that the center of Dane County is generally below the average number of foreclosures per census tract, a higher than average south of the center of the county, and that the eastern and northern boundaries have a higher than average number of foreclosures. Figure 6 represents the spatial distribution of the total number of foreclosures in Dane County in 2012. Figure 6 has a spatial pattern that matches Figure 5 in several ways, including a generally low number of foreclosures in census tracts running from the northeast to the southwest, with a very low number of foreclosures located in the center of Dane County, and higher numbers observed along the eastern and northern edges of Dane County. Figure 6 can be used in conjunction with Figure 5 in determining where we observe the greatest increases in the number of foreclosures between 2011-2012 (Figure 5) and where the number of foreclosures is the greatest in 2012 (Figure 6). Census tracts 116, 120.01, and 119 are among those that fit these criteria. Census tracts 114.01 and 114.02, while having high numbers of foreclosures in 2012, have not experienced as high of an increase compared to the tracts mentioned in the preceding sentence, and, therefore, do not fit with the criteria that has been set by the author (which can be adjusted; see conclusion).

Conclusion

The results show that not all census tracts are experiencing high numbers of foreclosures or an increase in foreclosures. There is a pattern of higher than average foreclosures on the northern and eastern boundaries of the county and south of Dane County's center. Lower than average foreclosures are generally found in the center of the county and to the immediate east of the county center. These findings are significant as that they can be used to guide county officials to where help may be most needed. Recommendations will be made to county officials that several census tracts, including tracts 116, 120.01, and 119, should be of immediate concern as they have had large increases between 2011-2012 along with high total foreclosures in 2012. A focus has been limited to counties that have a high number of foreclosures in 2012 and high increases from 2011-202 as county resources may not be able to effectively help and support numerous families with things such as financial aid, temporary housing, or nutritional needs. If there are enough county resources, an exception could be made. Some census tracts, such as tract 129 (Figure 6), have gone from low single to double digits in one year (2 to 16 in census tract 129's case), or have a high overall number of foreclosures, such as that observed in census tracts 114.01 and 114.02 (Figure 6). The reason for the increase in foreclosures is not known as limited data was utilized answering the study questions but it would be fair to assume that an increase in the number of foreclosures would be observed in 2013 for the following reasons: we observe an increase in total foreclosures from 2011-2012, which could suggest a trend, an economic downturn could occur resulting in even more foreclosures, the standard deviation map of 2012 (Figure 8) has an additional class that is >2.5 standard deviations from the mean, containing 3 census tracts, which is unlikely if the number of foreclosures observed is simply due to chance (3/106 or 2.8% against 1.6% expected, Figure 1). We also have a positively skewed distribution (as evidenced by the lower than expected standard deviation values on the left,<-0.5, of the curve as compared to higher than expected values on the right, >2.5) as seen in figure 8), there fewer census tracts that fall below <-0.5 standard deviations from the mean in 2012 as compared to 2011 (Figures 7 and 8), and there is always the possibility that we may see an increase due to chance as a normal distribution is a probability distribution. There, however, is no way to confirm that there will be an increase without additional data.

Z-Score Results

2011

|

2012

| |

Census Tract 25

|

-0.61

|

-.94

|

Census Tract 108

|

2

|

1.48

|

Census Tract 120.01

|

1.78

|

3

|

Figure 4: Z-Score Results for Selected Tracts, 2011 and 2012 Data

Probability Results

The number of foreclosures exceeded 80% of the time is 3.98 foreclosures, meaning that this number is very likely to be observed in a census tract.

The number of foreclosures exceeded 10% of the time is 24.97 foreclosures, meaning that this number is very unlikely to be observed in a census tract.

Figure 5: Changes in Foreclosures Between 2011-2012 in Absolute Values

Figure 8: Foreclosure Totals, 2012 Data

Figure 7: Foreclosures by Census Tract, 2011, Standard Deviation Classification Method

Figure 8: Foreclosures by Census Tract, 2012, Standard Deviation Classification Method